According to Bloomberg Green, China’s national carbon market opened with a “flurry of trades that sent prices surging.” This is exceptionally exciting news, yet Bloomberg’s annonymous report went on to enumerate many reasons why this is a less than stellar achievement, claiming that “it’ll be years before the system helps the top polluting nation curb its emissions.”

We say “bull pucky” to that. China pulls way ahead of the U.S. with this launch, which requires even state-owned oil giants such as China Petroleum & Chemical Corp., known as Sinopec, and China Energy Investment Corp., one of the world’s largest coal producers, to participate in trading carbon allowances. The frenzy produced a rise of 10%—deemed the daily limit—within about 10 minutes of the launch.

While there are always issues to be worked out whenever a new market is launched, as far it goes, China Carbon market’s first day was a huge success. Carbon allowances opened at 48 yuan ($7.42) a metric ton and traded as high as 52.80 yuan, limited by the defined max.

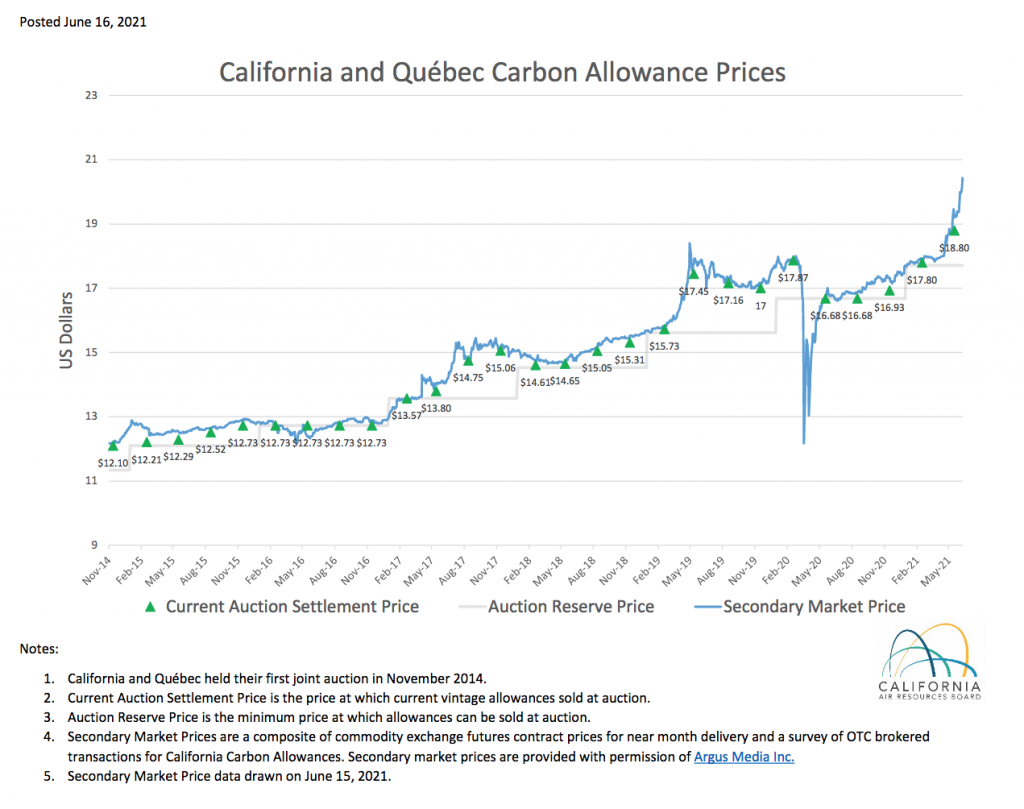

China’s carbon prices may be starting low but it won’t take long for them to exceed those of California’s Cap & Trade system, where the price of carbon started at $12 in November 2014 and which grew a total of 40% over the subsequent five years. It then languished at around $17 from 2019 until May of this year, when it suddenly began to climb. This performance is an embarrassment and shows the power of the fossil fuel lobby in California throughout the last decade, since the price of buying CO2 hovers at around $150 on the commondity market. China’s carbon market could theoretically exceed the price of carbon in California within a matter of weeks, even with a 10% daily cap.

China’s carbon prices may be starting low but it won’t take long for them to exceed those of California’s Cap & Trade system, where the price of carbon started at $12 in November 2014 and which grew a total of 40% over the subsequent five years. It then languished at around $17 from 2019 until May of this year, when it suddenly began to climb. This performance is an embarrassment and shows the power of the fossil fuel lobby in California throughout the last decade, since the price of buying CO2 hovers at around $150 on the commondity market. China’s carbon market could theoretically exceed the price of carbon in California within a matter of weeks, even with a 10% daily cap.

We are encouraged by China’s achievement and believe that they are moving along with an important tool to place the appropriate market signals on carbon emissions. It is not clear why Bloomberg feels the need to dis their efforts and diminish the importance of this launch but we believe this will light a fire under the U.S. to take more action, which may explain why the price of California’s permits started showing some upward movement in price during the May auction.

Read Bloomberg Green’s unsigned report, Top Carbon Market Launch Won’t Help China Tame Emissions Yet,“ posted July 15, 2021.